Semi-liquid ELTIFs were originally conceived to stimulate investment into real-economy infrastructure projects across Europe. Delivering a way for retail investors to access this blossoming asset class, there are plenty of reasons to be excited about the ELTIF emergence, write Kevin Hogan and Salman Tajak.

The general perception is that government spending focusses on short-term benefits, creating a challenge for infrastructure investment which requires a longer-term outlook. This means that those funding the spending for such projects through taxation may not see the immediate benefits. The dilemma for government, therefore, is to maintain public confidence in these ambitious future-proofing initiatives while still providing a fair return for those investing in these infrastructure projects.

Two well-known examples of future-proofing infrastructure projects in the EU that bring together government, public and private funding are the European Hydrogen Backbone and the Trans-European Transport Network. The future benefits of a transition to hydrogen-based industry, and more connected and sustainable travel across the continent respectively, are clear. Funding these projects so they deliver their long-term outcomes requires substantial capital today – and on an ongoing basis – to meet the project milestones.

This is where European long-term investment funds (ELTIFs) come in. ELTIFs are a type of semi-liquid fund that offers a way for investors to access illiquid alternative investment strategies, while providing regular capital for projects with ongoing and future deliverables.

Historically, long-term investments in illiquid assets have been confined to private markets and limited to large institutional and high net worth investors. With 10- to 15-year investment periods and no way of exiting or recovering money earlier, these close-ended investment vehicles are rigid in how they are managed. Investors make subscription commitments, but the funds are only required to be handed over when the investment manager has identified appropriate assets and they then request those funds from the investor. While waiting for these calls, investors’ capital is not in market, instead they must have it ready and available when the funds are called.

In January 2025, Funds Europe reported that U.S.-based Neuberger Berman had launched an ELTIF-style fund, the NB Private Equity Open Access Fund, which includes a selection of infrastructure companies as part of its portfolio, opening up private market investing to more retail investors in the EU. This is an example of how private markets are seizing the opportunity to service more types of investors. The Open Access Fund has a semi-liquid structure and will offer monthly subscriptions and quarterly redemptions and target 15% investment in liquid assets.

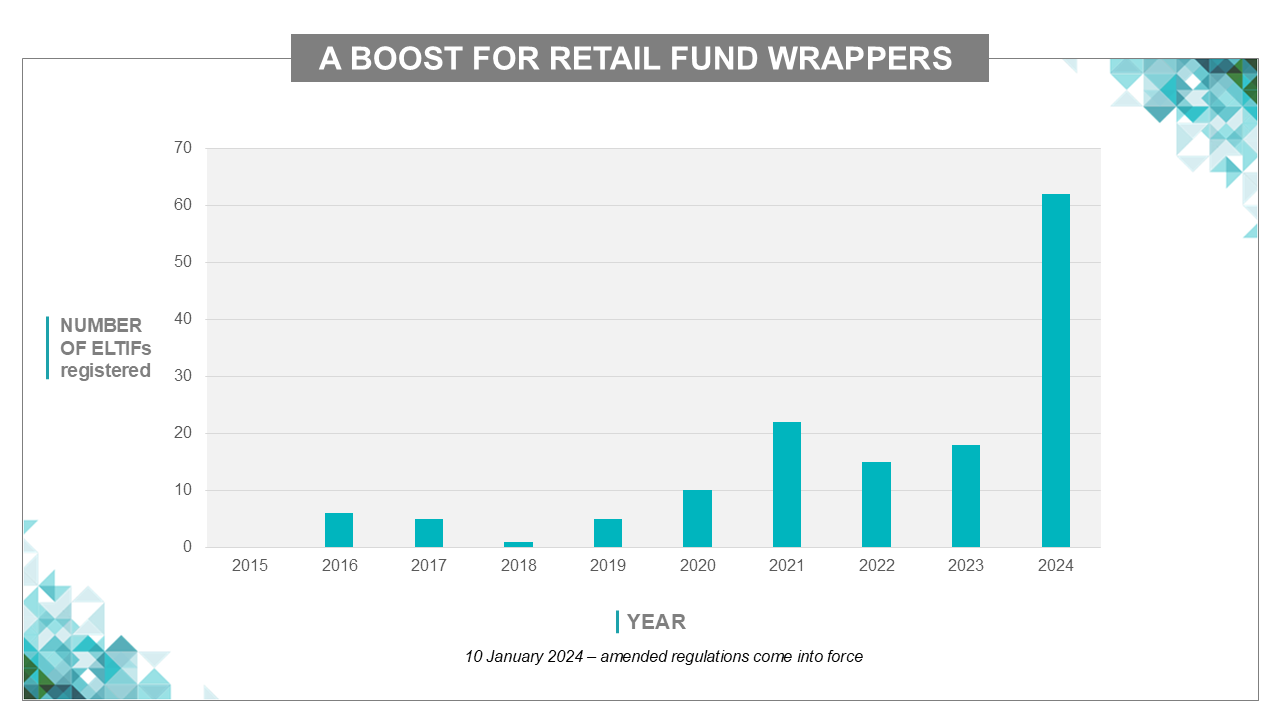

ELTIFs are managed by a European alternative investment fund manager (AIFM) and regulated by the national competent authority, such as the Central Bank in Ireland and the CSSF in Luxembourg. To administer them a fund manager needs the services of an authorised administrator and depositary, to make use of cross-border EU passporting. What makes these funds attractive, but also complex, is though the underlying investment is illiquid, its structure allows for limited liquidity which is what makes it a potential game-changer. These vehicles were first introduced into the EU in 2015 and in early 2024 the investment rules were amended and improved and by the end of 2024 there were almost 150 registered in Europe.

An illustration of the positive effects of ELTIF 2.0 in the market from the European Securities and Markets Authority (ESMA) register:

While private markets grapple with refining this balance between illiquid investing and liquidity for investors, the ELTIF moves the market closer to a solution. ELTIFs are flexible in the types of investments they can make, they are open to both professional and retail investors, and they offer liquidity on a limited basis within certain rules.

However, regulators around the world are extremely conscious that they must ensure that retail investors are protected and adequately informed about the investments they are making, and the risks associated with them. This has been the main reason regulators have prevented retail investors from investing in close-ended structures in the past.

ELTIFs form part of a group of investment vehicles referred to as evergreen funds, which broadly have many of the same characteristics. Both ELTIFs and evergreen funds offer private markets investments to more types of investors and both are designed to allow ongoing access to capital while maintaining a long-term investment strategy. You can read more about evergreen funds here.

What makes the ELTIF an appealing prospect is the range of possible assets it can invest in. For example, ELTIFs can invest in:

ELTIFs are by default close-ended products and therefore operate like any private market close-ended fund, in that they return funds through either distributions during an investment period or upon the fund winding up and returning proceeds at the end of the life of the investments.

What differentiates ELTIFs from other types of private funds is they can offer redemptions on a limited basis by maintaining sufficient liquidity in the fund. Additionally, minimum initial investment thresholds are comparatively low for ELTIFs compared to traditional private market investments, again making ELTIFs more appealing to retail investors.

The availability of redemptions, where the underlying investments are illiquid is complicated and various additional rules are present when offering a redemption option. For those who want to structure an ELTIF there are several questions to answer:

Both Ireland and Luxembourg have long-standing reputations in the market as attractive domicile choices for ELTIFs, because of their highly skilled workforces and robust regulatory processes. A year on from the amendment to the regulation, the changes to the way ELTIFs are structured is having the desired effect, accelerating interest in these types of funds.

To better facilitate the amendments to ELTIFs that have applied since 10 January 2024, the Central Bank of Ireland has streamlined the process of structuring for fund managers, with a shortened consultation time.

To launch an ELTIF, fund managers could make use of existing structures already being used for longer-term investments and so benefit from existing scaffolding such as legal frameworks and tax treaties.

In Ireland, ELTIFs can be structured in the following legal forms:

In Luxembourg ELTIFs can be structured in the following available legal forms:

While all these structures can be used, in Ireland ELTIFs tend to be structured as ICAVs or ILPs and in Luxembourg as SCSp, SCS or SCA, as these are the vehicles most used in private markets.

The ELTIF wrapper is an exciting development for the private markets industry. It is extremely flexible allowing the investment manager a certain freedom in the investment strategies they can pursue. It is very well suited to real assets, real estate, and credit fund investing as these assets have regular cashflows from rent or interest payments aiding the liquidity management of the ELTIF.

Launching an ELTIF follows the same timelines as a limited partnership, with a 24-hour approval process so long as all parties are correctly authorised in advance.

The Aztec Group is well-versed in the complexities involved in the administration of ELTIF products. Whether the ELTIF is regulated in Ireland or Luxembourg we have the expertise to support ELTIF fund setup and administration for our clients, while our integrated technology stack simplifies the calculation and reporting requirements.

To discuss how we can help you answer the questions raised in the article or support you to administer an ELTIF, please contact us below.

To discover for yourself what makes us the bright alternative and how we can support, please contact Kevin Hogan, our Global Head of Private Credit.