In April 2021, the European Commission adopted a legislative proposal for a Corporate Sustainability Reporting Directive (CSRD) which would require companies to report using a double materiality perspective under the European Sustainability Reporting Standards (ESRS), as Johanna Lam reports.

From the 5th January 2023, the CSRD entered into EU law, superseding the Non-Financial Reporting Directive (NFRD) which was initially implemented in 2014 to encourage companies to gear towards greater transparency and accountability on environmental, social, and governance (ESG) matters.

The CSRD has significantly increased the reporting requirements of companies falling within its scope and requires companies to report on the financial impact – and the impact of corporate activities – on the environment and wider society (double materiality). For the first time, reporting will be subject to limited and reasonable assurance.

What is double materiality?

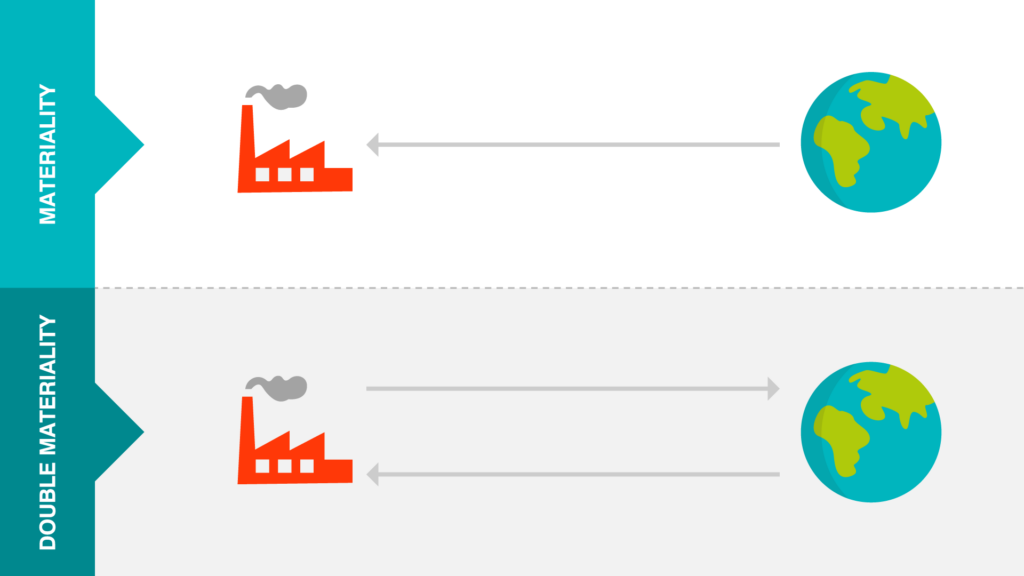

Double materiality takes our standard definition of materiality one step further in that it is not just environmental impacts on the company which can be material; but also, how a company’s activity can be material on the environment and society. The CSRD brings in this concept as part of its disclosure requirements, forcing companies to think about financial materiality and the impacts of business activities on people and planet.

Scope

Companies who are already in scope for NFRD will be required to report on CSRD from 2024, whilst companies defined as large (companies with >250 employees) will have to report from 2025. This scope will expand to include SMEs by 2026, meaning any company with 10 or more employees will soon have to report, including non-EU companies who wish to market themselves in the EU. By 2028, non-EU parent companies will be required to report via their large subsidiaries and branches within the EU.

Exemptions will apply to group entities where there are parent companies. Underlying entities can be exempt from reporting if the parent companies make available annual reports which include their underlying entities and branches.

Although there has not been any recognised equivalent framework to the CSRD, an additional exemption exists where, if a company has reported in line with another framework that the EU designates as a CSRD equivalent, exemptions will also apply. This exemption will become more apparent in the future when sustainability reporting progresses globally.

European Sustainability Reporting Standards (ESRS)

A set of reporting standards were developed by the European Financial Reporting Advisory Group (EFRAG), who have subsequently released the European Sustainability Reporting Standards (ESRS).

The ESRS is defined across 12 standards and incorporates existing reporting standards and frameworks such as the Taskforce for Climate-related Financial Disclosures (TCFD), the Sustainable Finance Disclosure Regulation (SFDR), and the EU Taxonomy Regulation, among many others, with the aim of harmonising relevant and existing frameworks. The good news is that if you have already started collecting sustainability data using existing standards or frameworks, it is unlikely that you will need to start from scratch.

Timing

The countless deadlines for disclosure requirements from different regulations makes timing difficult to manage. Fund managers must balance reporting requirements with publishing their own annual reports.

Volume of disclosures

On average, we’re seeing disclosures take up to 10 pages worth of information, and the volume is increasing as we see more disclosure requirements, as well as the number of people involved in the data collection process. Fund managers must make sure that disclosed information is presented in a meaningful and informative way, without it at the same time looking like information overload.

An integrated approach to sustainability

We are now moving away from sustainability being a separate reporting process to financial reporting. In future, sustainability information will likely sit alongside financial information, meaning it is not enough to have a separate sustainability report next to annual reports. Sustainability should be integrated into all aspects of the business for it to be fully considered, with disclosures clearly identifiable in a dedicated section in annual reports.

Information must be presented in a digital format

The CSRD requires all reports to be prepared in an electronic reporting format to facilitate accessibility, analysis, and comparability of reports. This means reports need to be in the XTML format and using XBRL technology, as per the European Single Electronic Format (ESEF). A taxonomy for the ESRS will be developed for the reported sustainability information to be tagged in accordance with those standards.

Assurance

For the first time, we will now be required to have all sustainability data assured by a qualified third party assurance provider. The EU Commission plans to release initial limited assurance standards followed by reasonable assurance standards later down the line to ensure the assurance process adopts the relevant due diligence needed. The assurance procedure intends to eventually follow the equivalent rigour of financial reporting.

Overall, the CSRD means that if your organisation has not begun to think about how to implement ESG and sustainability into its business practices, it is very likely that you will be in scope to do so in the near future. Companies will be required to understand what disclosures are material for their business, and adopt the double materiality assessment, which adds an extra layer of rigour to existing ESG considerations. This update is necessary and fund managers will have to ensure that data is accurate, available, and reported in the appropriate format.

To find out more, visit our quick guide to CSRD reporting and jargon explainer here.

Aztec’s ESG and Sustainability Services can help you understand your sustainability data requirements in relation to any of the content mentioned in this article. Our partnership with Worldfavor enables you to collect sustainability data from your portfolio companies, with Aztec providing data verification and analysis to meet any of your reporting requirements. Contact Johanna in our ESG and Sustainability team today.

To discover for yourself what makes us the bright alternative and how we can support, please contact Johanna Lam, our Senior Sustainability Executive.