ESG reporting is a non-negotiable for investment managers’ reporting practices, but without a standardised structure it can be difficult to adequately understand how all the regulations, standards and frameworks fit together. Dave Griffin shares a step-by-step guide.

ESG standards and frameworks can be difficult to navigate due to the sheer volume of disclosures that are either voluntary or mandatory in the market today. The lack of standardisation and definitive definitions makes it confusing for many, especially those who are starting their ESG journey.

Frameworks provide guidance, credibility, and readability on how disclosures should be prepared, structured, and categorised into key topics relevant to them within the defined boundaries.

Most frameworks are voluntary to help companies develop meaningful and effective reporting whilst providing flexibility in application. Although some frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) have been adopted as mandatory regulations across many jurisdictions, including the UK, U.S., and the EU.

Standards provide detailed reporting structures with comprehensive ESG criteria, usually stipulating which predefined metrics to disclose, along with a description of the methodology for collecting the data. An example of an ESG standard is the Global Reporting Initiative (GRI) announced as the official reporting standard of the United Nations Global Compact, making it the default reporting framework for more than 5,800 associated companies, or the Sustainability Accounting Standards Board (SASB) which offers disclosure standards for more than 75 industries to ensure information disclosed is most relevant to the financial performance of the organisation’s industry. Standards focus on financially material aspects so that the disclosure can help drive business and investment decisions.

Standards provide large companies with a repeatable and comparable reporting process. Whereas for small and medium sized enterprises with simpler value chains, it may be less practical to implement, and they may wish to go for a more flexible framework.

ESG reporting must be accurate, reliable, comparable, and material for each individual financial market participant. Selecting an ESG standard or framework to report on is entirely down to a company’s size, scope, data availability, and ambitions. See our ESG jargon buster here.

This means there is no one-size-fits-all solution, framework or methodology.

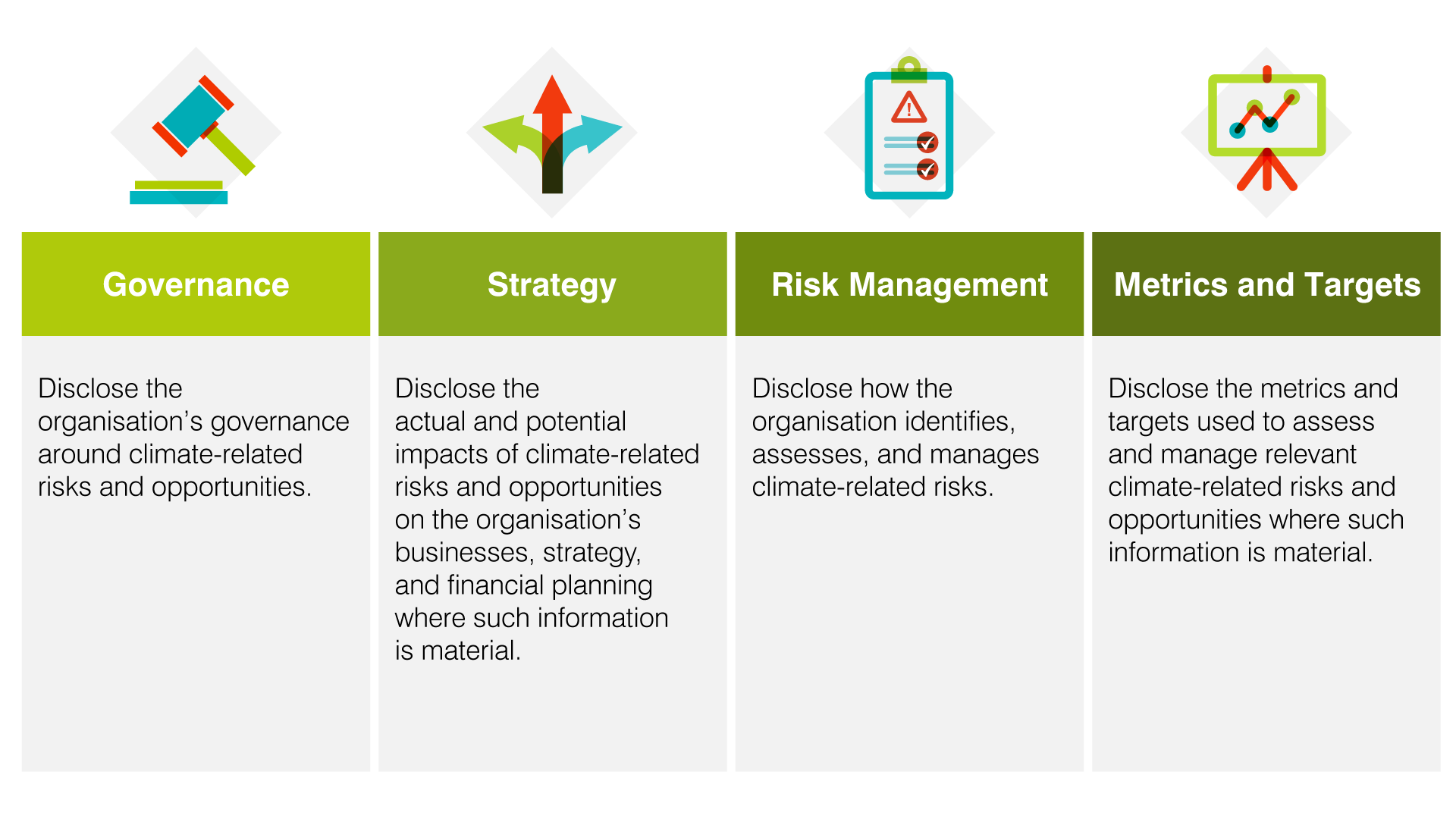

TCFD was developed to aid companies on what type of climate change disclosures to make to support investors, lenders, and insurance underwriters in appropriately assessing and pricing climate-change risks.

The 4 core areas of business that TCFD helps companies report on:

The International Sustainability Standards Board (ISSB) has developed sustainability standards that aim to achieve a high-quality, comprehensive global baseline of sustainability disclosures based on the needs of investors and the financial markets.

The standards are separated into two categories:

IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information

IFRS S2 Climate-related Disclosures

The Paris Agreement is a legally binding international treaty on climate change. It was adopted by 196 Parties at the UN Climate Change Conference (COP21) in Paris, France, on 12 December 2015. It entered into force on 4 November 2016.

Governments have agreed that the global average temperature must not be allowed to rise above 2 degrees Celsius, beyond which extreme climate impacts become more and more unmanageable (Paris Agreement 2015).

Science-based targets allow companies to work toward this overall goal by aligning corporate greenhouse gas (GHG) reductions with global emissions budgets generated by climate models. The Science-Based Targets Initiative – a partnership of CDP, a charity that runs the global environmental disclosure system; UN Global Compact, World Resources Institute (WRI) and the World Wildlife Fund (WWF) – has worked to develop such methodologies and tools to support companies in setting and working toward these kinds of targets.

According to Science Based Targets’ research there is a lot of scope for private markets to ramp up ESG reporting. As a snapshot, of the 17 million total private investable companies according to the S&P Global 2021, an estimated 0.03% of them reported to CDP. This is why a comprehensive guide has been published to offer guidance to PE firms that is tailored to the unique business models and asset classes when putting together their GHG inventory and developing science-based goals for their operations. This guide is updated annually.

Here’s an example of asset classes method options:

| ASSET CLASS | APPLICABLE TARGET SETTING METHODS |

| PE direct investments: buyout, growth, and venture capital | Sectoral Decarbonisation Approach is intended to help manage reporting on portfolio companies or assets that are more energy intensive/homogeneous to align their emissions reductions targets with a well-below 2 degrees or 1.5 degrees pathway. |

| PE direct investments: buyout, growth, and venture capital | SBT Portfolio Coverage Approach is where a PE firm sets a five-year target, using a selected metric (GHG or financial), to sufficiently cover portfolio companies setting their own SBTs, in with a linear trajectory to 100% of portfolio companies setting SBTs by 2040. |

| Private credit and PE direct investments: buyout, growth, and venture capital | The Temperature Rating Approach rates all portfolio companies with a temperature score, based on their GHG footprints and existing GHG targets. The PE firm then sets a target to reduce their aggregated temperature score to a minimum 2 degrees for the portfolio companies own Scope 1, 2 and 3 by 2040. |

| Fund of funds and secondaries | Optional Temperature rating targets and recommended actions. |

The below diagram shows the synergies between the International Sustainability Standards Board (ISSB) and existing sustainability frameworks. In November 2021, COP26 announced the launch of ISSB, which is designed to establish a global baseline for sustainability reporting.

An important part of this document is that it applies the financial materiality concept, which refers to a concept that determines whether the omission or mis-statement of information in a financial report would impact a reasonable investor’s decision-making.

The Aztec Group’s team can guide you to comply with ESG best practice, to find out more contact Dave Griffin.

To discover for yourself what makes us the bright alternative and how we can support, please contact Dave Griffin, our Head of Client Specialist Services.